The 2023 Ultimate Hack Guide to Bitcoin, Blockchain, & Cryptocurrency.

“Unlock the World of Bitcoin in 2023 with Our Ultimate Hack Guide! Explore Its Origins, Mechanics, & Why It’s Vital Today. Master Bitcoin Like a Pro!”

Introduction

In the ever-evolving landscape of digital finance, there’s one name that reigns supreme: Bitcoin. Welcome to the “2023 Ultimate Hack Guide to Bitcoin, Blockchain, & Cryptocurrency.”

In this comprehensive guide, we’ll take you on a journey through the world of Bitcoin, exploring its origins, mechanics, and significance in the context of cryptocurrency and blockchain technology.

The world of finance is undergoing a profound transformation, with cryptocurrencies at the forefront of this revolution.

At the heart of this transformation lies Bitcoin, the pioneer, and arguably the most influential cryptocurrency to date. To understand the broader cryptocurrency and blockchain ecosystem, one must first grasp the intricacies of Bitcoin.

Why is Bitcoin so crucial in this landscape?

Bitcoin is not just a digital currency; it’s a groundbreaking innovation that has disrupted traditional finance and challenged the very notion of money. Its significance extends beyond its market value or its potential for financial gain.

Understanding Bitcoin is essential because it represents the embodiment of the principles and technologies that underpin the entire cryptocurrency and blockchain industry.

Bitcoin’s inception in 2009 by the enigmatic Satoshi Nakamoto marked the beginning of a new era in decentralized digital finance.

It introduced the concept of blockchain, a revolutionary distributed ledger technology that has since given rise to a myriad of cryptocurrencies and blockchain applications.

Bitcoin’s creation was a response to the flaws and shortcomings of traditional financial systems, offering a vision of a peer-to-peer digital cash system that operates outside the control of centralized authorities.

As we delve into this ultimate guide, we’ll shed light on what Bitcoin truly is, how it operates, and why it matters more than ever in 2023.

Beyond the potential for financial gain, Bitcoin embodies the ideals of financial sovereignty, security, and transparency. It’s a symbol of the ongoing quest for a decentralized and more inclusive financial future.

So, whether you’re a seasoned cryptocurrency enthusiast looking to deepen your knowledge or a newcomer eager to explore this digital frontier, this guide will equip you with the insights and tools you need.

It will help you to navigate the world of Bitcoin, blockchain, and cryptocurrency with confidence and clarity. Let’s embark on this illuminating journey together.

Disclosure

Before delving further into the content, it’s essential to establish a foundation of clarity and transparency.

It’s worth noting that this post might have been enriched with affiliate links, which serve as a means to sustain the quality of this platform.

These links do not include any additional costs on your end; rather, they come with a distinct advantage – they grant me a modest commission, a portion that comes directly from the seller.

Intriguingly, some of these links also offer you a noteworthy benefit: exclusive discounts that are accessible through these very channels. It’s a win-win scenario.

By clicking and making purchases via these links, you extend your support toward the continuous upkeep and enhancement of this blog.

Your actions foster the creation of genuine, insightful content that’s dedicated to your enrichment.

It’s imperative to put forward that I find genuine satisfaction in endorsing tools and resources that I hold dear, employ regularly, and have personally vetted.

This ensures that the content I present is not only reliable but also backed by firsthand experience.

As you immerse yourself in the post, my sincere hope is that it serves you in meaningful ways. May it contribute to your knowledge reservoir or introduce you to new insights.

Your commitment is genuinely appreciated.

Wishing you an enlightening reading experience ahead!

I – Blockchain and Blockchain Technology

It’s inconceivable to talk about Bitcoin without talking about Blockchain or Blockchain Technology beforehand.

Blockchain, often dubbed as the backbone of cryptocurrencies like Bitcoin, is a revolutionary concept that has transformed the way we think about trust, security, and decentralized transactions.

In this section, we’ll delve into the fundamental concepts of Blockchain and Blockchain Technology, exploring how they have paved the way for the rise of cryptocurrencies and reshaped various industries beyond finance.

A – Origination of Blockchain or Blockchain Technology

Throughout human history, from ancient communities to today’s sprawling metropolises, people have always lived in groups, fostering a natural inclination to engage in transactions.

Over time, various methods have evolved to facilitate these exchanges efficiently and securely. However, the true breakthrough in transactional technology didn’t emerge until the financial crisis of 2008.

Enter Blockchain Technology, a concept that had been brewing since 1991 when pioneers like Stuart Haber and W. Scott Stornetta proposed a practical computational solution for time-stamping digital documents, aiming to eliminate backdating and tampering.

In 1992, scientist Merkle further enhanced this idea by introducing the Merkle Tree concept.

Yet, it wasn’t until 2004 that the technology gained real traction when computer scientist and cryptography activist Harold Thomas Finney introduced the RPoW (Reusable Proof of Work) system.

RPoW functioned by receiving non-exchangeable Hashcash tokens, associated with RSA-signed tokens, allowing transfers between individuals.

Notably, it addressed the critical issue of double spending, establishing trust through a globally accessible server that verified token correctness and integrity in real-time.

Despite its potential, RPoW remained largely underutilized until 2008, coinciding with the global financial crisis.

In response to the corrupt traditional banking system, a white paper surfaced, outlining a revolutionary decentralized, peer-to-peer electronic cash system: Bitcoin.

On January 3rd, 2009, Bitcoin came to life with its first block mined by the mysterious figure, Satoshi Nakamoto, who earned a 50 Bitcoin reward.

The first-ever Bitcoin transaction occurred on January 12, 2009, when Hal Finney received 10 Bitcoins from Nakamoto. This marked the beginning of an ever-expanding blockchain, forever altering the landscape of finance.

Unlike previous systems, Bitcoin relied on the Hashcash proof-of-work algorithm but replaced hardware-based trust functions with a decentralized, peer-to-peer protocol to track and verify transactions.

This innovation addressed the double-spending problem, ensuring that when someone sent funds, they couldn’t retain a copy—a stark contrast to sending an email while keeping the original.

In essence, individual miners mined Bitcoins using proof-of-work, and decentralized nodes within the network verified transactions.

Bitcoin’s inception heralded a new era in finance, one that promised greater transparency, security, and decentralization.

Join us on this journey through the history and significance of Bitcoin, blockchain, and cryptocurrency as we explore how they have shaped the world of finance and the future they hold.

B – What is Blockchain and How Does It Work?

Blockchain is a transformative technology that has redefined the way we store, secure, and exchange digital information.

It serves as the foundational technology behind cryptocurrencies like Bitcoin, but its applications extend far beyond digital currencies.

To understand the essence of blockchain, let’s break down its core components and explore how it operates.

01 – The Concept of a Blockchain

Blockchain Technology is often referred to as “The World Computer” for good reason.

It empowers developers within the Blockchain ecosystem to create, distribute, and securely share a wide array of projects, whether they pertain to politics, economics, or social endeavors.

While the potential applications are vast, our focus here is primarily on the economic aspect, aligning with the philosophy and vision of our website.

At its core, a blockchain is a distributed, decentralized ledger that records transactions across a network of computers. It is a transformative tool that enables multiple parties to collaborate without the need for mutual trust.

It has already left an indelible mark on the global economy in recent decades, serving as the foundational technology for digital currencies, commonly known as cryptocurrencies.

Unlike traditional centralized ledgers (like those maintained by banks or governments), a blockchain is maintained collectively by a network of participants, often referred to as nodes or miners.

Each participant has a copy of the entire blockchain, and they work together to validate and add new transactions to the ledger.

02 – Blocks and Transactions

So, what exactly is a blockchain?

The term “block” in blockchain refers to a collection of transactions. These transactions can represent various forms of digital information, not just financial transactions.

At its essence, a blockchain is a chain of blocks, each serving as a digital container for various types of information: transactions, property titles, ownership records, smart contracts, medical records, digital art, and more.

Think of these blocks as pages in a ledger, akin to traditional accounting records. Each block contains a set of transactions that are bundled together and added to the chain.

03 – Immutability and Cryptography

Once a block of transactions is added to the blockchain, it is cryptographically sealed and linked to the previous block, forming a chain of blocks.

This linkage makes it extremely difficult to alter the data in any block. Crucially, the information contained in these blocks is shielded by innovative cryptographic protocols, rendering post-facto alterations impossible.

Any change in one or multiple blocks has a cascading effect on all other blocks, ensuring the integrity and immutability of the entire ledger.

In fact, changing the information in one block would require altering all subsequent blocks in the chain, which is virtually impossible due to the computational power required.

It’s therefore this ingenious mechanism that births cryptocurrencies like Bitcoin, the pioneering digital currency that has become synonymous with the cryptocurrency world.

Bitcoin rewards network nodes that uphold the blockchain infrastructure, creating an incentive for participants to contribute to the Blockchain network’s operation.

04 – Decentralization

What sets blockchain apart which is also its key features is its decentralized nature; it doesn’t rely on a single server but rather maintains an identical ledger copy across all users within the network, forming what we call the “Blockchain network.”

Unlike centralized databases that rely on a single authority, blockchain operates on a peer-to-peer network.

This means there is no central authority governing the entire system. Instead, consensus algorithms are used to validate transactions and maintain the integrity of the ledger.

Common consensus mechanisms include Proof of Work (PoW) and Proof of Stake (PoS).

05 – Transparency and Security

Transactions on a blockchain are transparent and can be viewed by anyone on the network. While the identities of users are pseudonymous (represented by cryptographic addresses), the transaction details are visible.

This transparency, combined with the immutability of the ledger, enhances security and trust in the system.

06 – Distributed Ledger Technology (DLT)

Blockchain technology is often referred to as Distributed Ledger Technology (DLT) because it extends beyond the traditional financial sector.

DLT has the potential to transform various industries, including supply chain management, healthcare, voting systems, and more. It provides a secure, tamper-proof way to record and verify transactions and data.

07 – Smart Contracts

Blockchain can execute self-executing contracts known as “smart contracts.” These are programmable agreements that automatically execute predefined actions when specific conditions are met.

They have applications in various fields, such as legal agreements, automated payments, and supply chain management.

In summary, blockchain is a revolutionary technology that underpins cryptocurrencies like Bitcoin but offers far-reaching applications.

It’s a decentralized, transparent, and secure ledger system that records transactions in a tamper-resistant manner.

Understanding how blockchain works is crucial not only for cryptocurrency enthusiasts but also for professionals in various industries looking to harness its potential for innovation and efficiency.

Today, Blockchain Technology extends far beyond cryptocurrencies and is gaining ever-increasing attention in diverse applications.

It’s no longer confined to the realm of digital coins; it’s a transformative force with the potential to revolutionize numerous industries.

It’s worth noting that, despite their close association, Blockchain and Bitcoin are distinct entities.

Blockchain is not a currency itself but rather a secure ledger or spreadsheet present within each network, diligently recording transactions.

This distinction is vital for those new to the world of Blockchain, Bitcoin, and cryptocurrencies, as these terms are sometimes used interchangeably, leading to confusion.

Now, without further delay, let’s dive into the world of Bitcoin (BTC) as a cryptocurrency, exploring its unique attributes and the role it plays within the broader Blockchain ecosystem.

II – What is Bitcoin?

Bitcoin is the compound of the words “bit” and “coin”.

The bit is the most basic unit of information in computing and digital communications, which itself came from binary digits. And coin for coin (money coin in fiat currency).

According to Wikipedia.org, “Bitcoin (abbreviation: BTC; sign: ₿) is a decentralized digital currency that can be transferred on the peer-to-peer bitcoin network.

Bitcoin, often hailed as the pioneer of cryptocurrencies, represents a groundbreaking digital asset that has reshaped the world of finance.

In this section, we’ll delve into the core concept of Bitcoin, exploring its origins, underlying technology, and significance in the digital age. Join us on this journey to unravel the mysteries of the world’s first cryptocurrency.

A – Bitcoin: A Comprehensive Definition

Bitcoin is a revolutionary digital currency and decentralized payment system that has redefined the way we think about money and financial transactions.

At its core, Bitcoin is a form of digital or virtual currency, but it is unlike any traditional currency you might find in your wallet. Instead of physical coins or banknotes, Bitcoin exists solely in digital form, represented by cryptographic tokens.

The following are the key attributes of Bitcoin:

01 – Decentralization

Bitcoin operates on a decentralized network of computers, often referred to as nodes. These nodes collectively validate and record transactions on a public ledger known as the blockchain as we discussed earlier.

Unlike traditional currencies, there is no central authority, such as a government or central bank, controlling Bitcoin. This decentralization is one of its defining features, fostering a sense of trust and security among users.

02 – Cryptography

Bitcoin transactions are secured using advanced cryptographic techniques. Public and private keys are employed to initiate and verify transactions.

The public key serves as the recipient’s address, while the private key is kept secret and used to sign transactions. This cryptographic security ensures the integrity and privacy of each transaction.

03 – Blockchain Technology

The heart of Bitcoin is its underlying blockchain technology. A blockchain is a chain of blocks, each containing a list of transactions as we also discussed earlier.

Once a block is added to the chain, it becomes permanent and immutable, creating a transparent and tamper-resistant ledger.

This ledger is maintained and updated by a distributed network of nodes, ensuring the integrity of the entire transaction history.

04 – Limited Supply

Bitcoin’s supply is capped at 21 million coins, a deliberate design choice to mimic the scarcity of precious resources like gold.

This limited supply is programmed into the Bitcoin protocol, and new coins are generated through a process called “Mining.”

As a result, Bitcoin is often referred to as “digital gold,” and its scarcity has contributed to its perceived value.

05 – Peer-to-Peer Transactions

Bitcoin enables peer-to-peer transactions, allowing users to send and receive funds directly without the need for intermediaries, such as banks or payment processors.

This feature provides greater financial autonomy and can lead to reduced transaction costs.

06 – Transparency and Anonymity

While Bitcoin transactions are recorded on a Public Ledger, users’ identities are pseudonymous, identified by their public keys.

This provides a level of privacy, although the transparency of the blockchain means that all transactions are visible to anyone.

Bitcoin’s privacy features have led to discussions around its potential for both lawful and illicit activities.

07 – Global Accessibility

Bitcoin transcends borders and can be accessed and used by individuals anywhere in the world with an internet connection.

It offers a potential solution to financial inclusion issues in regions with limited access to traditional banking services.

In summary, Bitcoin is a digital currency that operates on a decentralized, transparent, and secure network.

Its creation marked a paradigm shift in how we perceive and interact with money, offering greater control, security, and financial autonomy to its users.

Over the years, Bitcoin has grown from a concept introduced by the pseudonymous figure Satoshi Nakamoto to a globally recognized and influential digital asset, sparking discussions about the future of money and finance.

B – Bitcoin’s Origin and the Enigmatic Creator, Satoshi Nakamoto

The story of Bitcoin begins with a profound mystery. In 2008, a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” was posted on a cryptography mailing list by an individual or group using the pseudonym Satoshi Nakamoto.

This white paper outlined the conceptual framework and underlying technology of what would later become the world’s first cryptocurrency, Bitcoin.

The White Paper:

In October 2008, the white paper authored by Satoshi Nakamoto was made public. It described a peer-to-peer electronic cash system designed to eliminate the need for intermediaries like banks in financial transactions.

The paper introduced the key concepts that would define Bitcoin, including decentralized consensus, cryptographic security, and the blockchain.

Satoshi Nakamoto:

The identity of Satoshi Nakamoto remains one of the greatest mysteries in the world of technology and finance.

Despite being the architect of a groundbreaking invention, Nakamoto’s true identity has never been conclusively revealed.

The name is widely believed to be a pseudonym, and Nakamoto’s anonymity was a deliberate choice to ensure the focus remained on the technology rather than a single individual.

Development of Bitcoin:

Following the release of the white paper, Satoshi Nakamoto started developing the Bitcoin software and mining the first Bitcoins.

On January 3rd, 2009, Nakamoto successfully mined the Genesis Block, the first block of the Bitcoin Blockchain, with a reward of 50 Bitcoins. This marked the official launch of the Bitcoin Network.

Early Contributors:

Satoshi Nakamoto was not alone in the early development of Bitcoin. Collaborators and contributors joined the project, helping to refine the code and expand the network.

These early developers played a crucial role in shaping the cryptocurrency’s foundation.

Mysterious Disappearance:

Around 2010, Satoshi Nakamoto gradually stepped back from the Bitcoin project and community discussions, eventually ceasing all communication and vanishing from the public eye.

The reasons for Nakamoto’s departure remain speculative, but it is widely believed to have been a measure to decentralize control and prevent undue influence.

Legacy and Impact:

Despite Nakamoto’s disappearance, the Bitcoin Network continued to grow and evolve. Bitcoin’s invention laid the foundation for an entire ecosystem of cryptocurrencies and Blockchain technologies.

Its decentralized nature, security features, and limited supply have made it a store of value and a means of digital exchange with global recognition.

The enigma of Satoshi Nakamoto and the humble beginnings of Bitcoin underscore the decentralized and collaborative nature of the cryptocurrency space.

While the creator’s identity remains unknown, their invention has transformed the world of finance, sparking innovation and discussions about the future of money, trust, and the potential for decentralized systems to reshape traditional institutions.

Satoshi Nakamoto’s white paper, released amid a global financial crisis, introduced a visionary concept that continues to influence the trajectory of the digital age.

C – The Significance of Bitcoin as the First Cryptocurrency

Bitcoin’s emergence in 2009 marked a historic moment in the world of finance and technology.

It introduced an entirely new concept—a decentralized digital currency—that has since disrupted traditional financial systems and inspired the creation of thousands of cryptocurrencies.

The significance of Bitcoin as the first cryptocurrency can be understood through several key dimensions:

01 – Pioneer of Cryptocurrency

Bitcoin is the pioneering cryptocurrency, the very first of its kind. It introduced the world to the concept of digital currencies that operate on a decentralized, peer-to-peer network.

Before Bitcoin, the idea of creating a digital currency that could function without intermediaries like banks or governments was largely theoretical.

02 – Decentralization and Trustlessness

Bitcoin’s core innovation lies in its ability to enable peer-to-peer transactions without relying on a central authority.

Unlike traditional currencies, which are controlled and regulated by governments and central banks, Bitcoin transactions are verified and recorded on a decentralized ledger called the blockchain.

This trustless system eliminates the need for intermediaries, making it resistant to censorship and providing users with greater financial autonomy.

03 – Security and Immutability

Bitcoin’s blockchain technology introduced a new level of security and immutability. Transactions are cryptographically secured and recorded in a tamper-resistant manner.

Once a transaction is added to the blockchain, it becomes virtually impossible to alter or erase, ensuring the integrity of the transaction history.

04 – Limited Supply and Digital Gold

Bitcoin’s design includes a capped supply of 21 million coins, mimicking the scarcity of precious resources like gold.

This limited supply has led to Bitcoin being dubbed “digital gold,” as it shares some characteristics with traditional store-of-value assets. The scarcity of Bitcoin has contributed to its perceived value and investment appeal.

05 – Global Accessibility and Inclusion

Bitcoin’s borderless nature means that anyone with internet access can participate in the network.

This has the potential to address financial inclusion issues in regions with limited access to traditional banking services.

Bitcoin empowers individuals to have control over their own finances without being subject to the limitations of the traditional banking system.

06 – Spurring Innovation

Bitcoin’s success and visibility as the first cryptocurrency have inspired a wave of innovation in the blockchain and cryptocurrency space.

It has led to the creation of various altcoins (alternative cryptocurrencies) and the development of blockchain-based applications that extend beyond digital currencies.

Ethereum, for example, introduced smart contracts, opening the door to decentralized applications (DApps).

07 – Shaping the Cryptocurrency Ecosystem

Bitcoin served as a blueprint for subsequent cryptocurrencies and laid the foundation for the cryptocurrency ecosystem. Its success established the credibility and viability of digital currencies as an asset class and investment vehicle.

08 – Changing the Discourse on Money

Bitcoin has sparked discussions about the nature of money, trust, and the role of central authorities in the financial system. It challenges conventional economic thinking and offers an alternative vision for the future of finance.

In conclusion, Bitcoin’s significance as the first cryptocurrency cannot be overstated. It has revolutionized the way we think about money, trust, and financial transactions.

Bitcoin’s pioneering spirit has not only spawned a vibrant ecosystem of cryptocurrencies and blockchain technologies but has also challenged traditional financial systems, inspiring a global movement toward greater financial autonomy and decentralized systems of value exchange.

III – How Does Bitcoin Work?

Understanding the inner workings of Bitcoin is essential for anyone looking to navigate the world of cryptocurrency.

In this section, we’ll demystify the processes that power Bitcoin, from transactions and mining to the security measures that make it a trusted digital currency.

Let’s uncover the mechanics behind this groundbreaking cryptocurrency.

A – Understanding Blockchain Technology and Its Role in Bitcoin

We’ve already talked about this earlier, but as we’ve also said earlier, one cannot talk about Bitcoin without talking about Blockchain technology; as the two concepts are highly intrinsically connected to each other.

Therefore, we are again going to delve into Blockchain technology here once again for the sake of understanding.

Blockchain technology is the foundational innovation that underpins Bitcoin and numerous other cryptocurrencies. It represents a revolutionary approach to recording and verifying transactions in a secure and decentralized manner.

To grasp the essence of Bitcoin, it’s crucial to delve into the fundamentals of blockchain technology:

01 – Decentralized Ledger

At its core, a Blockchain is a Digital Ledger, akin to a record-keeping system, where transactions are documented.

However, what sets it apart is its decentralized nature. Unlike traditional ledgers maintained by a central authority, such as a bank or government, a Blockchain operates on a network of distributed nodes (computers).

These nodes work together to validate and record transactions, ensuring no single entity has control over the ledger.

02 – Blocks and Transactions

The term “Blockchain” derives from its structure—transactions are grouped into “blocks.” Each block contains a collection of transactions.

When a block is filled with transactions, it is added to the Blockchain in chronological order. This sequential chain of blocks forms a complete transaction history, creating an unbroken and tamper-resistant record.

03 – Cryptographic Security

Cryptography plays a pivotal role in Blockchain security. Transactions on the Blockchain are cryptographically secured, ensuring the privacy and integrity of each transaction.

Public and private keys are used to initiate and verify transactions. The public key serves as the recipient’s address, while the private key is kept secret and is used to sign transactions, providing a secure means of verifying ownership.

04 – Immutability and Consensus

Once a transaction is recorded on the Blockchain, it becomes virtually immutable. The data in a block is linked to the previous block in the chain, and altering the information in one block would require changing all subsequent blocks.

This is a practically insurmountable task due to the computational effort involved.

Consensus mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS), ensure that network participants agree on the validity of transactions, maintaining the integrity of the ledger.

05 – Transparency and Verification

All transactions on the Blockchain are transparent and can be viewed by anyone with access to the network.

This transparency enhances trust and accountability. Anyone can verify the accuracy and authenticity of transactions, fostering a level of trust even in a trustless environment.

6 – The Role of Blockchain in Bitcoin

In the context of Bitcoin, the Blockchain serves as the ledger for all Bitcoin transactions. Every time a Bitcoin is sent or received, the details of the transaction are recorded on the Blockchain.

Miners, who are network participants with specialized hardware, validate these transactions, bundle them into blocks, and add them to the Bitcoin Blockchain.

07 – Security and Trustlessness

The Blockchain’s decentralized and cryptographic features make Bitcoin a trustful system. Users can transact directly with one another without relying on intermediaries like banks.

The blockchain ensures that transactions are secure and cannot be easily tampered with, providing a high level of trust in the system.

In summary, Blockchain technology is the innovative foundation upon which Bitcoin is built. It offers a decentralized, secure, and transparent method of recording and verifying transactions.

Bitcoin’s Blockchain is a public ledger that records all Bitcoin transactions, allowing for a peer-to-peer digital cash system that operates without the need for intermediaries.

Understanding the intricacies of Blockchain technology is essential for comprehending how Bitcoin functions and its transformative potential in the world of finance and beyond.

B – Mining, Transactions, and the Role of Miners in Bitcoin

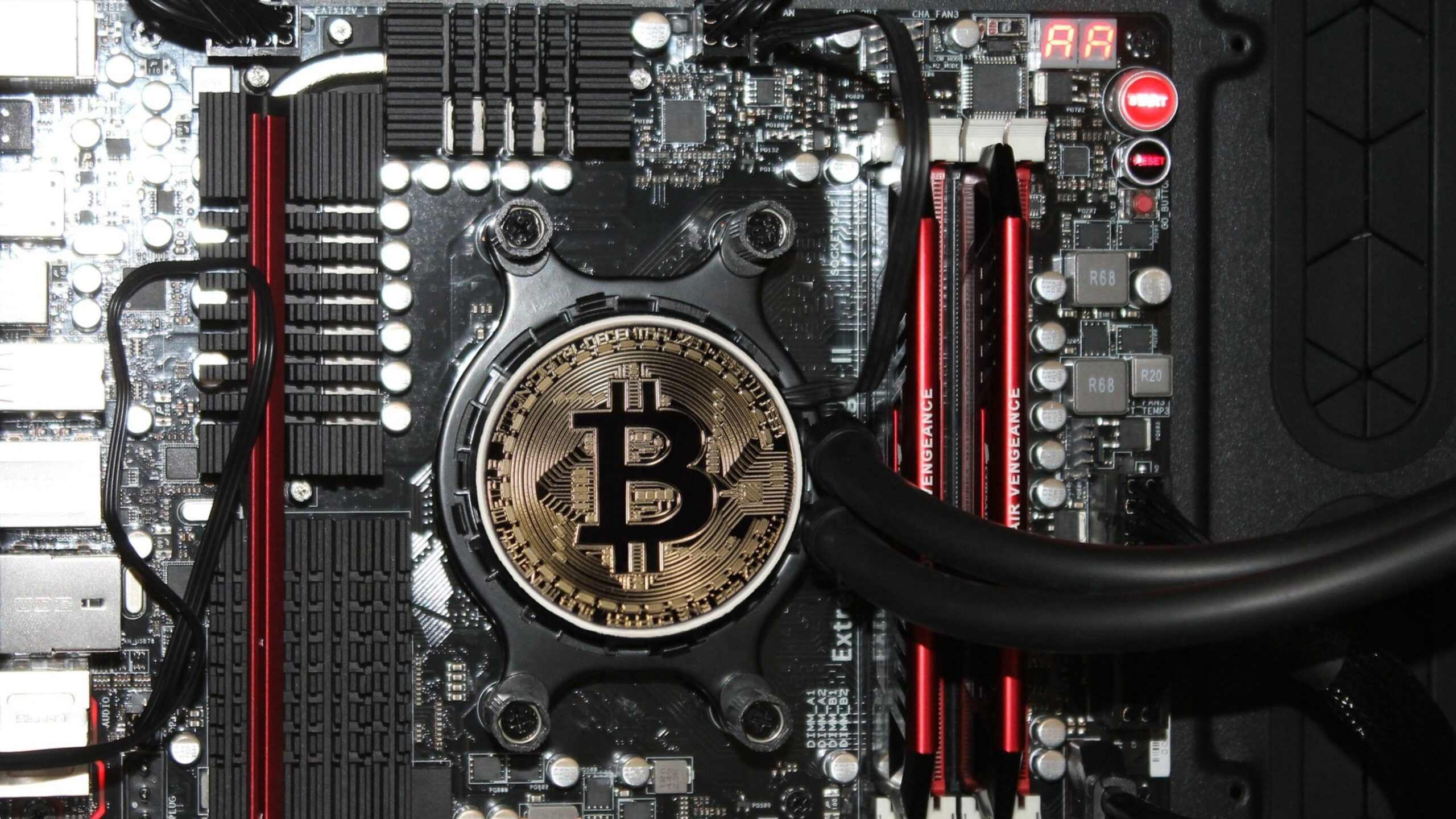

Bitcoin operates as a decentralized digital currency, and its underlying technology relies on a process called Mining to secure the network and validate transactions.

To understand this process fully, we need to explore the intricacies of Mining, the mechanics of transactions, and the indispensable role of Miners:

01 – Mining Overview

Mining is the process by which new Bitcoins are created and transactions are verified and added to the Blockchain.

Miners are participants in the Bitcoin Network who use specialized computer hardware to perform complex mathematical computations known as Proof of Work (PoW).

The first Miner to solve a PoW puzzle gets the opportunity to add a new block of transactions to the Blockchain and is rewarded with newly created Bitcoins (the block reward) and transaction fees.

02 – Transactions in Bitcoin

A Bitcoin transaction is a record of the transfer of digital funds from one user to another.

Transactions contain essential information, including the sender’s public key, the recipient’s public key (address), the amount of Bitcoin being sent, and a digital signature generated using the sender’s private key.

Once a transaction is initiated, it is broadcast to the Bitcoin network for verification and inclusion in the Blockchain.

03 – Role of Miners

Miners serve as the backbone of the Bitcoin Network. They play a pivotal role in validating transactions and maintaining the Blockchain’s integrity.

When a new transaction is broadcast to the network, it remains in a pool of unconfirmed transactions until a miner selects it for inclusion in a block.

Miners compete to solve a complex mathematical puzzle associated with a block of transactions. This puzzle is known as the PoW.

Solving the PoW requires significant computational power and consumes energy.

Miners must find a specific nonce (a random number) that, when combined with the transaction data and the previous block’s hash, generates a hash that meets certain criteria (a hash with a specified number of leading zeros).

The first Miner to successfully solve the PoW broadcasts the solution to the network, verifying all the transactions in the block.

Other Miners then validate this solution, ensuring its correctness and compliance with the Bitcoin protocol.

Once a consensus is reached that the solution is valid, the new block of transactions is added to the blockchain, and the Miner is rewarded with a block reward (currently 6.25 Bitcoins) and any transaction fees associated with the transactions in that block.

The newly added block becomes part of the Blockchain’s permanent history, and the transactions it contains are considered confirmed.

04 – Transaction Verification

Every Bitcoin node on the network maintains a copy of the Blockchain and independently verifies the validity of transactions and blocks.

Once a transaction is included in a block and added to the Blockchain, it is considered confirmed and irreversible.

The Blockchain’s decentralized nature ensures that all participants can independently verify the entire transaction history.

05 – Incentives for Miners

The Mining Process is incentivized to encourage Miners to dedicate their computational power and resources to secure the network.

In addition to the block reward and transaction fees, Miners play a crucial role in maintaining the trustworthiness of the Bitcoin network, which indirectly benefits all Bitcoin users.

In summary, Mining is a fundamental process in the Bitcoin Network that ensures the security and trustworthiness of the system. Miners validate transactions, add them to the Blockchain, and are rewarded for their efforts.

This intricate process of Mining, transactions, and consensus mechanisms forms the core of the decentralized Bitcoin Ecosystem, allowing it to operate as a peer-to-peer digital currency system without the need for a central authority.

C – Decentralized Ledger: Understanding and Implications

A Decentralized Ledger, often associated with Blockchain technology, is a revolutionary approach to recording and verifying transactions and information in a secure, transparent, and tamper-resistant manner.

To truly comprehend the concept and its implications, we need to explore its fundamental characteristics and the far-reaching consequences it has in various domains:

01 – Decentralization Defined

At its core, a Decentralized Ledger is a digital record-keeping system that is distributed across a network of computers, often referred to as nodes.

Unlike traditional centralized ledgers maintained by a single authority, such as a bank or government, a Decentralized Ledger is collectively managed and updated by a network of participants who have copies of the ledger.

02 – Key Characteristics

Distribution: The ledger’s data is replicated across multiple nodes in the network, ensuring that there is no single point of control that has failure.

Transparency: Transactions and data recorded on the ledger are visible to all participants in the network. This transparency enhances trust and accountability.

Security: The ledger employs cryptographic techniques to secure transactions, making it extremely difficult for unauthorized parties to alter or tamper with the data.

Immutability: Once information is recorded on the ledger, it is typically irreversible and resistant to modification. This immutability ensures the integrity of the ledger’s history.

03 – Implications of a Decentralized Ledger

Trustless Transactions: Decentralized Ledgers enable trustless transactions, meaning that participants can engage in transactions without the need to trust a central authority or intermediary.

This has profound implications for industries that rely on intermediaries, such as banks, for financial transactions.

Elimination of Intermediaries: In various sectors, the need for intermediaries is reduced or eliminated entirely. This leads to cost savings, faster processes, and increased efficiency.

Global Accessibility: Decentralized Ledgers are accessible to anyone with an internet connection. This inclusivity has the potential to address financial inclusion issues in regions with limited access to traditional banking services.

Enhanced Security: The cryptographic security measures inherent in Decentralized Ledgers make them highly resistant to fraud, hacking, and unauthorized access.

Reduced Counterparty Risk: Trustless transactions reduce the risk of counterparty default or fraud, as transactions are executed based on predefined rules and smart contracts.

Disruption of Existing Models: Industries ranging from finance to supply chain management are being disrupted by Decentralized Ledger technology.

Traditional models are being challenged by more efficient, transparent, and cost-effective alternatives.

04 – Blockchain as a Decentralized Ledger

Blockchain technology is one of the most prominent implementations of a Decentralized Ledger. It is a chain of blocks, each containing a set of transactions.

Once a block is added to the Blockchain, it becomes part of an immutable record that is verified and maintained by a distributed network of nodes.

Blockchain’s decentralized nature has profound implications for cryptocurrencies like Bitcoin, as it allows for peer-to-peer transactions without the need for intermediaries.

05 – Potential for Innovation

Decentralized Ledgers are fostering innovation across industries, including finance, healthcare, supply chain management, and voting systems.

Smart contracts, self-executing agreements with predefined rules, are made possible by Decentralized Ledger technology, enabling automation and efficiency in contract execution.

In summary, a Decentralized Ledger is a transformative concept that has far-reaching implications for trust, transparency, security, and efficiency in various domains.

It empowers participants to engage in trustless transactions, eliminates the need for intermediaries, and opens the door to new forms of innovation.

As Blockchain and Decentralized Ledger technology continue to evolve, their impact on traditional systems and industries is poised to be profound and disruptive.

IV – Why Bitcoin Matters in 2023?

In this section, we’ll explore the continued relevance and significance of Bitcoin in the year 2023.

Bitcoin’s impact on finance, technology, and the global economy has evolved over the years, making it more essential than ever to understand why it matters in the current landscape.

Let us as delve into the key factors driving Bitcoin’s importance in 2023.

A – The Current State of the Cryptocurrency Market in 2023

The Cryptocurrency Market, which began with the creation of Bitcoin in 2009, has undergone remarkable growth and transformation over the years.

As we delve into The Current State of the Cryptocurrency Market in 2023, several key factors and trends come into focus:

01 – Market Capitalization

The Cryptocurrency Market has reached unprecedented levels in terms of Market Capitalization.

In 2023, the total Market Capitalization of all cryptocurrencies combined has exceeded trillions of dollars. This reflects the growing interest and investment in digital assets.

02 – Bitcoin Dominance

Bitcoin, as the first and most recognized cryptocurrency, continues to maintain a dominant position in the market.

It often comprises a significant portion of the total Market Capitalization, signaling its enduring appeal as a digital store of value.

03 – Diversification of Assets

Beyond Bitcoin, the cryptocurrency market has witnessed a proliferation of alternative cryptocurrencies, often referred to as altcoins.

These coins serve a variety of purposes, from enabling smart contracts (e.g., Ethereum) to focusing on privacy (e.g., Monero).

NFTs (Non-Fungible Tokens) have gained significant attention as unique digital assets representing ownership of digital or physical items, such as art, music, and virtual real estate.

04 – Institutional Adoption

Institutional participation in the Cryptocurrency Market has surged. Established financial institutions, hedge funds, and corporations have allocated significant capital to Bitcoin and other digital assets.

The introduction of Bitcoin and cryptocurrency-related investment products, such as ETFs (Exchange-Traded Funds), has provided more accessible avenues for institutional investors to enter the market.

05 – Regulatory Landscape

Governments and regulatory bodies have been actively examining and, in some cases, implementing regulations about cryptocurrencies.

The regulatory environment varies by region, with some countries embracing cryptocurrencies and others imposing restrictions or bans.

06 – DeFi and Web3

The emergence of DeFi (Decentralized Finance) platforms has transformed the financial industry by providing decentralized lending, borrowing, trading, and yield farming.

Web3, which envisions a decentralized internet powered by Blockchain technology, is gaining momentum with the aim of increasing user control and data ownership.

07 – Scalability and Sustainability

Scalability remains a critical challenge for many Blockchain Networks, with ongoing efforts to improve transactions throughout and reduce fees.

Sustainability concerns surrounding the energy consumption of Blockchain Networks, particularly proof-of-work networks like Bitcoin, have sparked discussions about transitioning to more eco-friendly consensus mechanisms.

08 – Geopolitical Considerations

Cryptocurrencies have become part of the geopolitical landscape, with governments exploring the use of digital currencies and CBDCs (Central Bank Digital Currencies).

Cryptocurrencies are also being considered as a means to evade economic sanctions, which has led to discussions about the regulatory response.

09 – Volatility and Investor Awareness

Cryptocurrency Markets continue to exhibit volatility, with significant price fluctuations. This characteristic can present both opportunities and risks for investors.

As more people become aware of cryptocurrencies, there is a growing need for financial education and literacy to navigate this evolving asset class.

In conclusion, the Cryptocurrency Market in 2023 is characterized by significant growth, increased institutional participation, and a diverse ecosystem of digital assets.

While Bitcoin remains a cornerstone, the emergence of DeFi, NFTs, and Web3 technologies is driving innovation and reshaping the financial and digital landscape.

Regulatory developments, scalability challenges, and sustainability concerns also contribute to the evolving nature of the market.

Understanding the current state of the Cryptocurrency Market is essential for anyone considering participation or investment in this dynamic and transformative space.

B – Recent Developments, Price Trends, and Mainstream Adoption in the Cryptocurrency Market

This section provides a comprehensive overview of the most noteworthy recent developments, prevailing price trends, and the increasing mainstream adoption of cryptocurrencies in the current landscape.

Delve into the dynamic world of digital assets to understand their evolution, challenges, and opportunities.

01 – Recent Developments in the Cryptocurrency Market

Explore the latest developments shaping the cryptocurrency market, including innovative trends, emerging technologies, and notable events that have had a significant impact on the evolving landscape of digital assets.

Stay informed about the dynamic changes occurring within the cryptocurrency ecosystem.

a – Metaverse and Virtual Reality (VR)

The Cryptocurrency Market is witnessing increasing integration with the Metaverse, a digital, immersive virtual environment.

NFTs and virtual real estate are key components of this trend, allowing users to own and trade virtual assets within these virtual worlds.

b – Decentralized Autonomous Organizations (DAOs)

DAOs are organizations governed by smart contracts and decentralized decision-making processes.

They have gained prominence as a way to manage decentralized projects, raise funds through token sales, and make collective decisions without centralized authorities.

c – Layer 2 Scaling Solutions

Layer 2 Solutions, such as the Lightning Network for Bitcoin and Ethereum’s Optimistic Rollups, aim to improve scalability and reduce transaction fees.

These technologies enable faster and more cost-effective transactions on Blockchain Networks.

d – Cross-Chain Compatibility

Cross-chain technology is becoming increasingly important. Projects like Polkadot and Cosmos are enabling interoperability between different Blockchain Networks, allowing assets and data to move seamlessly between them.

Price Trends:

02 – Price Trends in the Cryptocurrency Market

Gain insights into the price dynamics of cryptocurrencies, including notable fluctuations, trends, and market sentiment.

Understand how digital asset prices are influenced by various factors and the implications for investors and the broader cryptocurrency ecosystem.

a – Bitcoin’s Volatility and Store of Value Narrative

Bitcoin’s price has experienced periods of significant volatility, with both sharp increases and corrections.

It continues to be viewed as a digital store of value and a hedge against inflation, attracting investors seeking an alternative to traditional assets.

b – Altcoin Season and Speculative Activity

The cryptocurrency market often sees “altcoin seasons” where alternative cryptocurrencies experience rapid price appreciation. These periods are characterized by speculative trading and heightened market activity.

c – Stablecoins and Pegged Assets

Stablecoins like USDC and USDT have gained popularity as a way to transact in the cryptocurrency market while avoiding the price volatility associated with other cryptocurrencies.

Pegged assets, such as algorithmic stablecoins, are also being explored.

03 – Mainstream Adoption in the Cryptocurrency Market

Discover how cryptocurrencies are increasingly becoming part of mainstream financial and technological landscapes.

Explore the key drivers and milestones that have propelled digital assets into the mainstream, reshaping the way individuals and institutions engage with this innovative asset class.

a – Institutional Investment

Institutional players, including asset management firms, hedge funds, and publicly traded companies, have allocated significant capital to Bitcoin and cryptocurrencies.

High-profile endorsements and investments have bolstered the legitimacy of the asset class.

b – Payment Integrations

Major payment processors like PayPal and Square now allow users to buy, sell, and use cryptocurrencies for payments. This has facilitated cryptocurrency adoption for everyday transactions.

c – Central Bank Digital Currencies (CBDCs)

Several countries are actively researching and piloting their own CBDCs, digital representations of national currencies. These initiatives have the potential to reshape the way people transact digitally.

d – Regulatory Clarity and Frameworks

Regulatory agencies in various countries are working to establish clear guidelines for the cryptocurrency industry. Regulatory frameworks provide a level of certainty for businesses and users, encouraging responsible adoption.

e – Education and Awareness

Increased educational efforts and media coverage have raised awareness about cryptocurrencies. This has led to a broader understanding of the technology and its potential applications.

In summary, recent developments in the cryptocurrency market include integration with the Metaverse, the rise of DAOs, Layer 2 scaling solutions, and efforts to achieve cross-chain compatibility.

Price trends continue to exhibit volatility, with Bitcoin maintaining its role as a store of value and altcoins seeing speculative activity.

Mainstream adoption is driven by institutional investment, payment integrations, CBDC exploration, regulatory developments, and efforts to enhance education and awareness.

The cryptocurrency market remains a dynamic and evolving space, with ongoing innovations and adaptations shaping its trajectory.

C – Bitcoin’s Role as a Store of Value and Digital Gold

Bitcoin has garnered significant attention and adoption as a digital asset with two distinct but interrelated roles: a store of value and a digital representation of gold.

Understanding these roles is essential to grasp Bitcoin’s position in the modern financial landscape:

01 – Store of Value

A store of value is an asset that retains its purchasing power over time. People seek to store wealth in assets that can preserve or even appreciate in value, protecting it from inflation or economic uncertainties.

Bitcoin has increasingly been recognized as a store of value due to several key characteristics:

Scarcity: Similar to precious metals like gold, Bitcoin has a capped supply of 21 million coins. This scarcity is programmed into its protocol, making it immune to inflationary pressures.

Decentralization: Bitcoin operates on a Decentralized Network of nodes, which means it is not controlled by any single entity, government, or central bank.

This decentralization enhances trust in its ability to maintain value independently of traditional financial systems.

Security: Bitcoin’s Blockchain technology ensures the security and immutability of transactions and ownership records. This security feature enhances its appeal as a reliable store of value.

Global Accessibility: Bitcoin is accessible to anyone with an Internet connection, making it a borderless store of value.

Bitcoin’s store of value narrative gained prominence during economic crises and periods of currency devaluation in various countries. People turned to Bitcoin as a hedge against economic instability and inflation.

02 – Digital Gold

The concept of Bitcoin as “digital gold” draws parallels between the cryptocurrency and the traditional precious metal:

Scarcity: Gold is valued for its scarcity, and Bitcoin shares this attribute. Both assets have a finite supply.

Portability: Bitcoin’s digital nature allows for easy transfer and storage, similar to the portability of gold.

Divisibility: Like gold can be divided into smaller units, Bitcoin is divisible into satoshis, making it accessible for microtransactions.

Store of Value: Gold has historically served as a store of value, and Bitcoin is seen as a digital counterpart fulfilling the same role.

The term “digital gold” highlights Bitcoin’s potential to emulate gold’s function as a long-term store of value and a hedge against economic uncertainty.

Implications and Significance

Bitcoin’s role as a store of value and digital gold has wide-reaching implications:

Diversification: Investors include Bitcoin in their portfolios to diversify risk and protect against traditional market volatility.

Cross-Border Transactions: Bitcoin facilitates cross-border transactions without the need for intermediaries, making it appealing for international trade.

Financial Inclusion: Bitcoin provides access to financial services for individuals who lack access to traditional banking systems.

Monetary Policy Debate: Bitcoin’s existence has sparked discussions about the role of central banks, monetary policy, and the potential for alternative currencies.

In conclusion, Bitcoin’s emergence as a store of value and digital gold signifies a paradigm shift in the way individuals and institutions perceive and use digital assets.

Its unique characteristics, including scarcity, decentralization, and security, position it as a reliable hedge against economic uncertainty and inflation.

The digital gold narrative further solidifies its role as a valuable asset in a rapidly evolving financial landscape.

V – How to Buy and Store Bitcoin?

This section provides a comprehensive guide on the steps and considerations involved in purchasing and securely storing Bitcoin.

Whether you’re new to cryptocurrencies or an experienced investor, understanding the process of acquiring and safeguarding your digital assets is crucial.

Explore the essential aspects of buying and storing Bitcoin to make informed decisions in the world of digital finance.

A – How to Acquire Bitcoin: A Comprehensive Guide

Acquiring Bitcoin is the first step to entering the world of cryptocurrencies.

Whether you’re a newcomer or an experienced investor, there are multiple methods to obtain Bitcoin, including through exchanges or peer-to-peer (P2P) platforms.

This comprehensive guide will walk you through the process:

01 – Choose a Method

Exchanges: Cryptocurrency exchanges are online platforms where you can buy, sell, and trade Bitcoin. They offer various benefits, such as liquidity, convenience, and a range of trading pairs.

Peer-to-Peer (P2P) Platforms: P2P platforms connect buyers and sellers directly, allowing for more privacy and flexibility. Popular P2P platforms include LocalBitcoins, Paxful, and Binance P2P.

02 – Select a Reliable Exchange or P2P Platform

Research and choose a reputable exchange or P2P platform. Look for user reviews, security features, and the availability of customer support.

03 – Create an Account

For exchanges, sign up for an account by providing your email, creating a strong password, and completing any required identity verification (KYC) procedures.

P2P platforms may have different registration processes. Follow the platform’s instructions to create an account.

04 – Verify Your Identity (KYC)

Most exchanges require identity verification to comply with regulatory requirements. This typically involves providing identification documents such as a passport, driver’s license, or proof of address.

05 – Deposit Funds

Once your account is verified, deposit funds into your exchange account. Common funding options include bank transfers, credit/debit cards, and cryptocurrency deposits.

06 – Place an Order

On the exchange, you can place an order to buy Bitcoin. Common order types include market orders (buy at the current market price) and limit orders (set a specific price at which you want to buy).

07 – Secure a Wallet

It’s essential to have a secure cryptocurrency wallet to store your Bitcoin safely. Wallets come in various forms:

Software Wallets: These are applications or software programs that you install on your computer or mobile device. Examples include Exodus, Electrum, and Trust Wallet.

Hardware Wallets: Hardware wallets are physical devices that store your Bitcoin offline, providing a high level of security. Popular options include Ledger Nano S, Ledger Nano X, and Trezor.

Paper Wallets: A paper wallet is a physical printout of your Bitcoin address and private key. It’s kept offline and is one of the most secure methods of storage.

08 – Withdraw Bitcoin to Your Wallet

After purchasing Bitcoin on the exchange, withdraw it to your secure wallet. This ensures that you have control over your private keys and funds.

09 – Consider Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging (DCA) is an investment strategy used to mitigate the impact of price volatility when buying assets, such as stocks, cryptocurrencies, or mutual funds, over time.

It involves investing a fixed amount of money at regular intervals, regardless of the asset’s current price. The key principles of DCA are as follows:

a – Consistent Investments: With DCA, you commit to investing a fixed amount of money at predetermined intervals, typically monthly or quarterly. This fixed investment amount remains constant over time.

b – Buying Regardless of Price: DCA involves purchasing the chosen asset at regular intervals, regardless of whether its price is high or low. This means you buy more of the asset when prices are low and less when prices are high.

c – Averaging Out Price Fluctuations: By consistently buying at different price points, DCA helps average out the impact of price fluctuations over time. This means you don’t need to time the market to make purchases at the “perfect” price.

d – Reducing Emotional Decision-Making: DCA removes the emotional element from investing. It prevents investors from making impulsive decisions based on market volatility or fear and greed.

e – Long-Term Perspective: DCA is best suited for long-term investors who believe in the potential of the asset but want to reduce the risks associated with market timing.

Example of Dollar-Cost Averaging:

Suppose you want to invest $1,000 in a particular cryptocurrency over the course of a year. Instead of investing the entire $1,000 at once, you decide to use DCA:

Month 1: You invest $100 when the cryptocurrency is priced at $10 per unit, buying 10 units.

Month 2: The price has risen to $12 per unit. You invest another $100, buying 8.33 units.

Month 3: The price has dropped to $9 per unit. You invest $100, buying 11.11 units.

And so on, repeating this process for 12 months.

At the end of the year, you have accumulated a total of approximately 100 units of the cryptocurrency, even though the price fluctuated during the year.

This approach allows you to spread your risk and avoid making large, potentially mistimed investments.

DCA is often favored by investors who prefer a disciplined, low-stress approach to investing and who are focused on the long-term growth potential of their chosen assets.

It can help smooth out the impact of market volatility and reduce the risk associated with trying to time the market.

However, it’s important to note that DCA does not guarantee profits or protect against all potential losses; it is simply a strategy to manage risk and reduce the impact of short-term price fluctuations.

B – Bitcoin Storage and Security: A Comprehensive Guide

This guide provides a comprehensive overview of the critical aspects of storing and securing your Bitcoin holdings.

Discover the best practices, tools, and strategies to protect your digital assets from theft, loss, and unauthorized access.

Whether you’re new to cryptocurrency or an experienced investor, understanding Bitcoin security is essential for safe and responsible ownership.

01 – Secure Your Private Keys

If you use a software wallet, ensure that you secure your private keys and back up your wallet’s “recovery phrase”. For hardware wallets, follow the manufacturer’s instructions for setup and backup.

02 – Practice Safe Storage: Ensuring the Security of Your Bitcoin

The security of your Bitcoin holdings is paramount in the world of cryptocurrencies.

As a digital asset, Bitcoin relies on robust security practices to protect against theft, loss, and unauthorized access.

Here are essential considerations for practicing safe storage:

a – Choose the Right Wallet:

Select a secure cryptocurrency wallet that suits your needs. Consider factors such as convenience, security features, and your level of technical expertise. Common wallet options include software wallets, hardware wallets, and paper wallets.

b – Secure Your Private Keys:

Your private keys are the keys to your Bitcoin kingdom. They grant access to your funds and should be kept private at all times.

Never share your private keys with anyone, and be cautious of phishing attempts or scams designed to trick you into revealing them.

c – Use a Hardware Wallet:

For the highest level of security, consider using a hardware wallet. These physical devices store your private keys offline, making them extremely resistant to hacking and malware attacks.

Popular hardware wallets include Ledger Nano S, Ledger Nano X, and Trezor.

d – Set Up Two-Factor Authentication (2FA):

Enable 2FA on your exchange accounts, software wallets, and any other services associated with your cryptocurrency holdings.

This extra layer of security requires you to provide a one-time code generated by an authentication app or sent to your mobile device when accessing your accounts.

e – Implement a Backup Strategy:

Back up your wallet’s private keys or recovery phrase (seed phrase) securely.

Store copies of this information in multiple physical locations that are safe from theft, damage, or loss. Consider using fireproof and waterproof containers for physical backups.

f – Be Wary of Phishing and Scams:

Cryptocurrency users are often targeted by phishing emails, fake websites, and social engineering scams.

Verify the authenticity of websites and emails before entering any sensitive information. Double-check URLs and avoid clicking on suspicious links.

g – Keep Software Updated:

Ensure that your wallet software and operating system are up to date with the latest security patches. Regularly update your wallet’s firmware if you use a hardware wallet.

h – Use Secure Networks:

When accessing your cryptocurrency accounts or making transactions, use secure and trusted networks. Avoid public Wi-Fi networks, especially for sensitive operations.

i – Create a Will or Inheritance Plan:

In the event of your incapacity or passing, consider creating a plan for your heirs to access your cryptocurrency holdings. This may involve sharing instructions and recovery information securely with trusted individuals.

j – Regularly Audit Your Holdings:

Periodically review your cryptocurrency holdings and transactions to ensure accuracy and detect any unauthorized activity. Monitor your wallet addresses and balances to identify any unusual changes.

k – Educate Yourself:

Stay informed about the latest security practices, threats, and best practices in the cryptocurrency space. Knowledge is your best defense against security risks.

l – Consider Multi-Signature Wallets:

Multi-signature wallets require multiple private keys to authorize a transaction. They offer an added layer of security by distributing control among multiple parties or devices.

By diligently following these safe storage practices, you can significantly reduce the risks associated with holding and managing Bitcoin.

Remember that the security of your Bitcoin is ultimately your responsibility, and taking proactive steps to protect your assets is essential for a worry-free cryptocurrency experience.

03 – Tax and Reporting: Navigating the Cryptocurrency Tax Landscape

As cryptocurrencies gain widespread adoption, it’s crucial to understand the tax implications associated with buying, selling, and holding digital assets.

Tax authorities in many countries have recognized cryptocurrencies as taxable assets, which means you must comply with tax laws and reporting requirements.

Here’s a comprehensive look at the tax and reporting aspects of cryptocurrency:

a – Tax Classification:

Cryptocurrencies are often classified as property or assets for tax purposes, rather than traditional currencies. The specific tax treatment can vary by jurisdiction and may include capital gains tax, income tax, or other forms of taxation.

b – Record Keeping:

Maintain detailed records of your cryptocurrency transactions. This includes the date, time, amount, and purpose of each transaction, as well as wallet addresses, transaction IDs, and counterparties’ information.

c – Capital Gains Tax:

In many countries, when you sell or exchange cryptocurrencies for a profit, you may be subject to capital gains tax. The tax rate can vary depending on factors like the duration of your ownership (short-term or long-term) and your overall income.

d – Income Tax:

Cryptocurrency received as payment for goods or services is typically considered taxable income. This includes mining rewards, airdrops, and payments received in cryptocurrency. Ensure you report this income accurately.

e – Cost Basis:

Calculate the cost basis of your cryptocurrencies, which is the original purchase price, to determine the capital gain or loss when you sell or trade them.

Some jurisdictions allow for specific methods like FIFO (First-In-First-Out) or LIFO (Last-In-First-Out) for cost-basis calculations.

f – Reporting to Tax Authorities:

Depending on your jurisdiction, you may be required to report your cryptocurrency holdings and transactions to tax authorities. This can involve filing additional forms or disclosures specifically related to cryptocurrencies.

g – Tax Professionals:

Consider consulting with a tax professional or accountant who specializes in cryptocurrency taxation. They can guide tax planning, compliance, and strategies to minimize your tax liability legally.

h – Deductions and Credits:

Be aware of any deductions or tax credits related to cryptocurrency activities that may be available in your country. These can include deductions for mining expenses or incentives for certain crypto-related activities.

i – Reporting Losses:

If you incur losses from cryptocurrency transactions, you may be eligible to offset capital gains with capital losses. Properly document and report these losses to potentially reduce your overall tax liability.

j – International Tax Considerations:

If you engage in cross-border cryptocurrency transactions or hold assets in international exchanges, understand the tax implications of international tax treaties and regulations.

k – Keep Up with Regulatory Changes:

Cryptocurrency tax laws and regulations can change over time. Stay informed about updates and changes in your country’s tax code to ensure compliance.

l – Seek Legal Advice:

If you have complex cryptocurrency holdings, engage legal counsel experienced in cryptocurrency law and tax compliance to navigate intricate regulatory landscapes.

m – Be Proactive:

It’s essential to be proactive in addressing tax obligations. Avoiding or evading taxes can lead to penalties, fines, or legal consequences.

Cryptocurrency taxation is a complex and evolving field, and tax laws can vary significantly from one jurisdiction to another.

Staying informed and adhering to tax regulations is essential to ensure compliance and avoid potential legal issues.

It’s advisable to consult with tax professionals who can provide guidance tailored to your specific circumstances, helping you navigate the cryptocurrency tax landscape with confidence and compliance.

By following this comprehensive guide, you can confidently acquire Bitcoin through exchanges or P2P platforms and ensure its secure storage.

Whether you’re investing for the long term or exploring the potential of cryptocurrencies, responsible and informed actions are key to a successful journey in the world of Bitcoin and digital assets.

VI – Common Bitcoin Myths and Misconceptions

In this section, we’ll debunk prevalent myths and misconceptions surrounding Bitcoin.

Gain a clearer understanding of this cryptocurrency by separating fact from fiction and making informed decisions about Bitcoin’s role in your financial strategy.

A – Debunking Common Bitcoin Misconceptions

Bitcoin, as a revolutionary digital currency and asset, has garnered significant attention and generated its fair share of myths and misconceptions.

Here, we aim to clarify and debunk some of the most prevalent misconceptions surrounding Bitcoin:

01 – Misconception 1: Bitcoin Is Anonymous

Reality: Bitcoin transactions are not entirely anonymous but pseudonymous. While they do not directly reveal users’ identities, transaction details are recorded on the Public Blockchain Ledger.

With the right tools and analysis, it’s possible to trace transactions to specific addresses.

However, users can enhance their privacy through practices like coin mixing and using privacy-focused cryptocurrencies.

02 – Misconception 2: Bitcoin Is Only Used for Illegal Activities

Reality: While Bitcoin has been used in some illegal activities due to its pseudonymous nature, the majority of Bitcoin transactions are legitimate.

Bitcoin serves as a borderless digital currency, facilitating legal transactions, international remittances, and investments.

Many governments and businesses recognize its legitimacy and are adopting Blockchain technology.

03 – Misconception 3: Bitcoin Is Wasteful in Energy Consumption

Reality: Bitcoin’s energy consumption is a subject of debate. Bitcoin Mining indeed requires significant computational power, which consumes electricity. However, it’s essential to consider the context.

Traditional banking and gold mining also consume substantial resources. Additionally, Bitcoin Mining can be powered by renewable energy sources, reducing its environmental impact.

The Cryptocurrency Industry is actively exploring more sustainable practices.

04 – Misconception 4: Bitcoin Has No Intrinsic Value

Reality: Critics argue that Bitcoin lacks intrinsic value because it’s not backed by physical assets like gold or government guarantees.

However, Bitcoin’s value derives from its utility as a decentralized and censorship-resistant store of value and medium of exchange.

Its scarcity, security, and utility in the digital age contribute to its value proposition.

05 – Misconception 5: Bitcoin Is Illegal Everywhere

Reality: Bitcoin’s legal status varies by country. While some nations have banned or heavily regulated it, others have embraced and regulated it as a legitimate financial asset.

The legality of Bitcoin depends on local laws and regulations. It’s crucial to research and adhere to your country’s specific rules regarding cryptocurrency.

06 – Misconception 6: Bitcoin Is a Get-Rich-Quick Scheme

Reality: Bitcoin’s price volatility attracts speculators seeking quick profits, but it’s essential to recognize that investing in Bitcoin carries risks.

Success requires a long-term perspective, informed decision-making, and an understanding that price fluctuations are common. Prudent investors diversify their portfolios and manage risk.

07 – Misconception 7: Bitcoin Is a Bubble That Will Burst

Reality: Bitcoin has experienced multiple price bubbles and subsequent corrections in its history. However, it has also shown resilience and continued to grow over the long term.

While speculative bubbles can occur, Bitcoin’s underlying technology and adoption suggest it may have lasting value.

08 – Misconception 8: You Need to Buy a Whole Bitcoin

Reality: Bitcoin is divisible into smaller units called satoshis. You can buy fractions of a Bitcoin to suit your budget. Owning a whole Bitcoin is not necessary, as you can start with any amount you’re comfortable with.

09 – Misconception 9: Bitcoin Transactions Are Instant

Reality: Bitcoin transactions require confirmation on the Blockchain, which can take time.

The speed of confirmation depends on network congestion and transaction fees. While some transactions are near-instant, others may take minutes or even hours.

Conclusion

Debunking these misconceptions is essential for a more accurate understanding of Bitcoin’s role in the Digital Economy.

Bitcoin’s value, legality, and energy consumption are complex topics, and a nuanced perspective is crucial for informed decision-making.

Staying informed and critically evaluating information in the cryptocurrency space is key to dispelling misconceptions and making well-informed choices.

B – Accurate Information for Debunking Common Bitcoin Myths

01 – Myth 1: Bitcoin Is Anonymous

Reality: Bitcoin transactions are pseudonymous, meaning they are not directly linked to a user’s identity.

However, all Bitcoin transactions are recorded on a Public Ledger known as the Blockchain, which can be analyzed.

Users can enhance privacy by using practices like coin mixing or transacting through privacy-focused cryptocurrencies like Monero or Zcash.

02 – Myth 2: Bitcoin Is Only Used for Illegal Activities

Reality: While Bitcoin has been used in some illegal activities due to its pseudonymous nature, the majority of Bitcoin transactions are legitimate.

Bitcoin is widely used for legal purposes, including international remittances, online purchases, and investments.

Many governments and businesses recognize its legitimacy and are adopting Blockchain technology for various applications.

03 – Myth 3: Bitcoin Is Wasteful in Energy Consumption

Reality: Bitcoin mining does consume electricity, primarily due to the Proof of Work (PoW) consensus mechanism.

However, it’s essential to consider the context. Traditional banking systems and gold mining also consume significant resources.

Moreover, Bitcoin Mining can be powered by renewable energy sources, reducing its carbon footprint. The Cryptocurrency Industry is actively exploring more energy-efficient consensus mechanisms.

04 – Myth 4: Bitcoin Has No Intrinsic Value

Reality: Bitcoin’s value is derived from its utility as a decentralized and censorship-resistant store of value and medium of exchange.

Its scarcity, security, and utility in the Digital Age contribute to its value proposition. While it lacks physical backing, it has gained recognition as a legitimate asset class.

05 – Myth 5: Bitcoin Is Illegal Everywhere

Reality: Bitcoin’s legal status varies by country. While some nations have banned or heavily regulated it, others have embraced and regulated it as a legitimate financial asset.

The legality of Bitcoin depends on local laws and regulations. Many countries are working on clear regulatory frameworks for cryptocurrencies.

06 – Myth 6: Bitcoin Is a Get-Rich-Quick Scheme

Reality: Bitcoin’s price volatility attracts speculators, but it’s essential to recognize the risks.

Success in Bitcoin investing requires a long-term perspective, informed decision-making, and risk management.

Prudent investors diversify their portfolios and understand that price fluctuations are common.

07 – Myth 7: Bitcoin Is a Bubble That Will Burst

Reality: Bitcoin has experienced multiple price bubbles and corrections in its history.

While speculative bubbles can occur, Bitcoin’s underlying technology and growing adoption suggest it may have lasting value.

It has shown resilience and continued to grow over the long term.

08 – Myth 8: You Need to Buy a Whole Bitcoin

Reality: Bitcoin is divisible into smaller units called satoshis. You can buy fractions of a Bitcoin to suit your budget. Owning a whole Bitcoin is not necessary, as you can start with any amount you’re comfortable with.

09 – Myth: Bitcoin Transactions Are Instant

Reality: Bitcoin transactions require confirmation on the Blockchain, which can take time. The speed of confirmation depends on network congestion and transaction fees.

While some transactions are near-instant, others may take minutes or even hours. Newer technologies like the Lightning Network aim to facilitate faster and cheaper transactions.

Conclusion

Debunking these myths with accurate information is essential for a better understanding of Bitcoin’s role in the Digital Economy.

Bitcoin’s value, legality, and energy consumption are complex topics that require a nuanced perspective.

Staying informed and critically evaluating information in the cryptocurrency space is key to dispelling myths and making well-informed choices.

VII – Bitcoin’s Future: Trends and Predictions

In this section, we explore the potential future of Bitcoin. Gain insights into emerging trends, technological developments, and expert predictions regarding Bitcoin’s role in the evolving financial landscape.

Stay informed about the possibilities and challenges that lie ahead for this pioneering cryptocurrency.

Bitcoin, as a dynamic and innovative digital currency, continues to evolve. Its future holds both opportunities and challenges as it adapts to changing technologies and market dynamics.

Here, we delve into the emerging trends and expert predictions that shape Bitcoin’s future:

A – Emerging Trends and Technologies

The Lightning Network: The Lightning Network is a second-layer solution built on top of the Bitcoin Blockchain.

It aims to address Bitcoin’s scalability and speed issues by enabling fast and low-cost transactions through payment channels.

As it continues to grow, the Lightning Network enhances Bitcoin’s utility for everyday transactions.

Taproot Upgrade: Taproot is a significant upgrade to Bitcoin’s underlying technology. It introduces improvements in privacy, smart contracts, and transaction efficiency.

Taproot enhances Bitcoin’s fungibility and makes it more versatile for various use cases.

Institutional Adoption: Institutional interest in Bitcoin has surged, with prominent companies and financial institutions investing in Bitcoin or providing Bitcoin-related services.

This trend is expected to continue as Bitcoin gains recognition as a store of value and a hedge against inflation.

Regulatory Developments: Governments worldwide are working on regulatory frameworks for cryptocurrencies. Clear regulations can provide legal clarity and boost institutional participation while addressing concerns about illicit activities.

DeFi Integration: Bitcoin’s integration with Decentralized Finance (DeFi) platforms is a growing trend. DeFi applications built on Bitcoin networks enable users to earn interest, borrow, and trade assets in a decentralized manner.

B – Expert Predictions and Forecasts